Enterprise Resource Planning software has made a significant impact on businesses across the world. Countless businesses are currently using ERPs to manage operations and functions. But the VAT Tax being implemented by governments worldwide has created another challenge for businesses.

For those not familiar with VAT tax, it can be defined as an indirect tax levied on goods and services throughout the production process, ultimately adding to the end-sale price. VAT tax may not seem burdensome for a business as its cost eventually falls on the consumer’s shoulders. But the challenge with VAT tax is how it’s percentage is derived, implemented and calculated on different stages of production. Such as tax will affect the cost of entire functions in any business including HR, purchase, supply chain, marketing and operations.

So, what do you do? Hire a Tax expert? If you are currently using an ERP, does it offer Tax compliance features? Keeping in mind the above-mentioned points, VAT tax offers little room for adjustments and should be included in the internal structure of any business.

There are many software programs such as Peachtree which are offering VAT compliance platforms, but none are in alliance with government’s guidelines. However, VCA has been created within the region’s economic guidelines and fiscal policies.

VCA Tax Compliance ERP

Tax executing processes are not found in traditional ERP systems. But Value Creation Automation has taken up the challenge of VAT tax processes and given businesses a sign of relief. This unique automation software is designed to compute tax without manual support and comprehensively calculate tax to costs across the production process.

VCA, Value Creation Automation, as the name suggests, is geared towards creating value for businesses and customers alike. The program is easy-to-use and offers a modern approach to enhancing business functionality and making tax calculation a breeze.

What you will find in VCA VAT ERP?

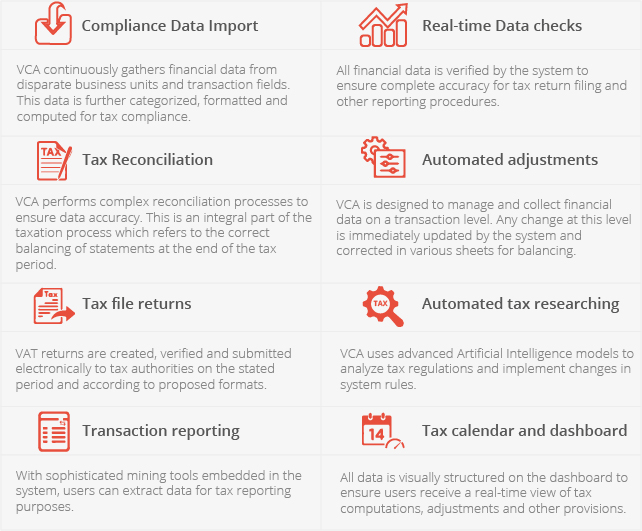

VCA is not limited to just VAT computations, but rather combines a feature-rich accounting platform for businesses. With entire accounting, financial and tax-related platforms integrated onto a unified system, tax computations and compliance become fully automated.

Some of the key features you will find in VCA VAT software are:

VCA VAT automation is aimed at making your business streamlined with the new fiscal policies across the region. The software will help you materialize the following benefits:

- Lower costs

Hiring an expert for tax returns and filing is another additional cost. But VCA, you don’t have to increase your costs. In fact, VCA can help you minimize costs and shave off any expense related to manual staffing, manual documentation, errors and inaccuracies, time delays and more.

- Faster processes

Taxing and filing returns can be a tiring and time-consuming process even with accurate data. It is important to remember that VAT is levied on various production stages and must be computed accordingly. With VCA, all tax computations are automated and conducted on designated production processes in real-time, without manual dependency. This significantly makes the entire taxation process faster.

- Reduced errors

All transaction related errors are eradicated in real-time through effective risk analysis. Tax returns are corrected and updated to ensure compete accuracy by VCA. This means you never have to worry about delays caused due to errors in reporting.

- Zero manual dependency

No more reliance on manual spreadsheets and other tools for tax computations. VCA create and compiles all tax-related databases. You can save a fortune and not have to worry about hiring more staff for accounting and tax purposes.

- On-time Reporting

All reports are created in real-time using accurate transaction data. Users can retrieve reports on their dashboards through granted access. Reports can be customized to meet various business and tax requirements.

With VCA, tax compliance challenges no longer remain a problem. Whether you own a small business or a large business, making your firmVAT compliant is necessary, and the time to prepare is now. If you are concerned regarding costs of VAT compliance software such as VCA, it is deemed affordable as compared to other software programs. VCA requires no capital costs, no hardware installation and is cloud-accessible. The designers of VCA aim to help businesses prepare for VAT tax and give them the right tools to grow in the middle east.

You can receive a free consultation with VCA experts by calling at +971-04-5195999 or visiting www.cordis.us